This might be the best case study yet of Friends Provident Foundation using all of our endowment to progress our mission of a fair and sustainable economy. As a capitalised charity, we are supporting a just transition to net zero via our grant giving, shareholder engagement with investee companies, and direct social impact investing.

Today, we are supporting the launch of the LSE report ‘Just Zero: 2021 report of the UK Financing a Just Transition Alliance’, which follows a three year programmeme that we funded with two grants totalling £270,000.

This very successful programmeme mobilised 40 banks, investors, and other financial institutions along with universities, civil society and trade unions to launch the Financing a Just Transition Alliance, the first grouping of its kind in the UK. In the ‘Just Zero’ report, the Alliance sets out what the delivery of a just transition in the UK will require, highlights initial efforts by leading financial institutions towards achieving a just transition, and points to what is needed to achieve system-wide change.

Friends Provident Foundation actually appears in the report with two case studies covering pioneering and best practice.

The first is our programmeme of shareholder engagement with the energy utility sector in partnership with Royal London Asset Management (RLAM). We have been engaging the energy market on the trends transforming the power sector since 2018, and since 2019, this engagement has been informed by and has informed, LSE GRI’s recommendations and business expectations framework in a virtuous circle of academic development and practical testing that has produced excellent results.

As a result of our engagement, SSE plc published the world’s first dedicated just transition strategy from an energy company in November 2020. It establishes 20 principles to embed fairness into decarbonisation plans, divided into what’s needed to ‘transition out’ of high-carbon and ‘transition in’ to net zero. It addresses the needs of four key stakeholder groups we identified: workers, communities, suppliers, and consumers.

In the run up to COP26, SSE has been joined by EDF, Scottish Power, and Centrica, in publishing formal just transition strategies as a result of our engagement. These also cover the four key stakeholder groups we identified.

The second case study relates to capital allocation and our financing of SMEs in community energy, with Riding Sunbeams highlighted – the first company to embed facilitating a just transition into its articles of association.

In 2020, we invested £100,000 in Riding Sunbeams, a joint venture between Community Energy South, the climate charity Possible, and Thrive Renewables. This followed a grant of £100,000 in 2019 to support business development.

Riding Sunbeams seeks to decarbonise the transport system by developing community-owned renewable energy assets and using the electricity generated to power railways. It has huge potential to unblock barriers to community energy, providing a commercial route to market and enabling large regional energy users, like railway networks, to both decarbonise and add value to the communities they operate in.

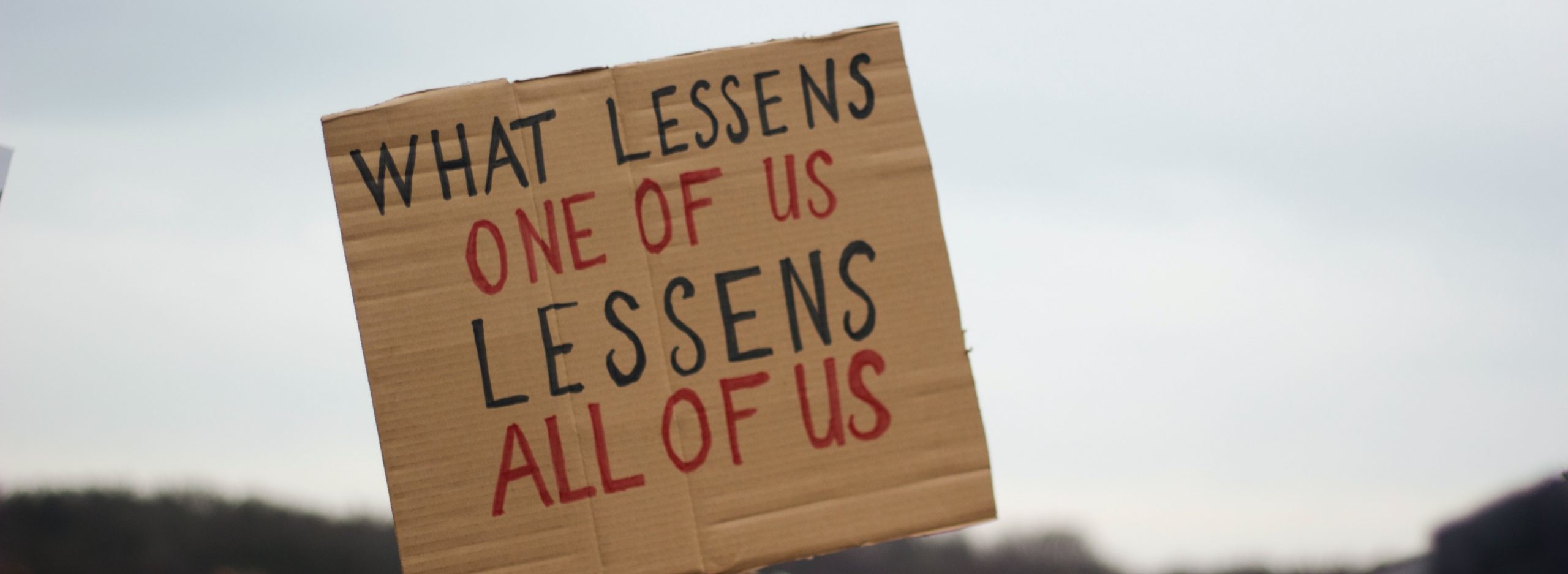

We require rapid transition to a net-zero emission pathway but for this to be resilient, it must also be a just and fair transition, and go hand in hand with ensuring a more sustainable and equitable society.

As a capitalised charity, we are leveraging all our endowment to support that objective.