Financial Inclusion: Annual Monitoring Report 2022

Author: Friends Provident Foundation

Date: 12/12/2022

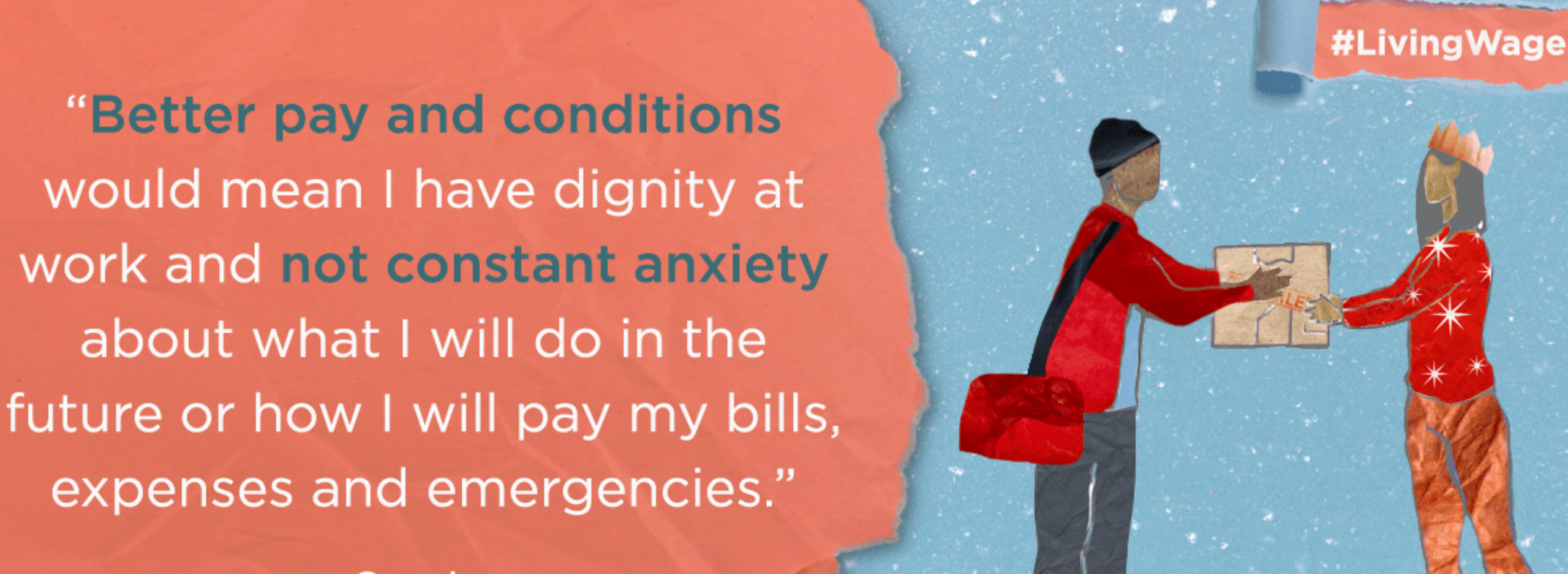

Poorest citizens ‘worn down’ as financial inclusion remains distant dream for the UK. The UK has made little progress in the last decade towards creating a truly financially inclusive society, a new study reveals.

Whilst unemployment is the lowest it has been since the mid-1970s, both real earnings and access to secure work have declined in recent years, with a growing number of people placed on zero hours contracts over the last decade, according to the report.

Unemployed individuals have seen their income from social security fall significantly over the last 10 years. With an individual’s level and security of income a key driver of financial inclusion, those on the lowest incomes are left with no capacity to withstand the current cost-of-living crisis.

Led by the Centre on Household Assets and Savings Management (CHASM) at the University of Birmingham, the report – published today – demonstrates how little progress has been made towards a truly financially inclusive society.

With the current cost-of-living crisis, too many people in the UK are unable to manage day-to-day, meet one-off expenses and avoid problem debt. It is our hope that policymakers will use our findings to drive through changes that will support vulnerable people today, and rebuild their resilience for a more positive future.

Professor Adele Atkinson, School of Social Policy

The consequences of these increasing challenges on people’s health and relationships are stark. Latest data from October this year found that more than one in three of the population say that they have experienced financial difficulties over the past year, with 81% of these people saying it has affected their mental and/or physical health, and more than half saying it has affected their relationships.

The report reveals some progress in relation to financial inclusion over the last decade, with fewer people lacking access to bank accounts and more people having access to private pensions. However, the authors – Professor Adele Atkinson, University of Birmingham, Professor Karen Rowlingson, University of York, and Professor Stephen McKay, University of Lincoln – note that those who remain unbanked face problems in an increasingly cashless economy, and that access to private pensions will not contribute to financial security whilst so many people pay little or nothing into their funds.

Friends Provident Foundation and Barrow Cadbury Trust, supporters of the monitor for the last 10 years, commented: “Financial inclusion and reducing vulnerability to financial shocks has never been more relevant to millions of people now facing a cost-of-living crisis. The team at CHASM and academic partners have been analysing the data and the policy for ten years, providing a sound evidence base for policy, regulation and action. Friends Provident Foundation and Barrow Cadbury Trust are proud to have supported this work to maintain a focus on financial inclusion.”

You can download the report below.

Latest Resources

Resource

The Foundation Practice Rating 2023/2024 Report

Blog

Friends Provident Foundation Seeking Values-Aligned Investment Advice

We are seeking to appoint an external adviser on an ongoing basis to provide advice on our investment portfolio.

Resource

Investment Principles and Policy

The guiding document for how Friends Provident Foundation invests.

Resource

Citizens’ Economic Council report

Can involving the public in economic policy-making help the UK tackle the cost-of-living crisis?

Blog

Unleashing the Potential of Impact Measurement in Listed Equities: The crucial role for asset managers (part 1 of 2)

Impact investing is gaining traction, driven by asset owners seeking positive impact.

Resource

Bellwether interviews brief

Opportunity Alert! Join us in reshaping the economic landscape!

Blog

Learning to change: Evidence-based practices to support a Just Transition

The global pursuit of a sustainable future has never been more urgent.

Resource

Learning to change: Evidence-based practices to support a Just Transition

In this report, we delve into the groundbreaking insights derived from three Foundation-funded projects.

Blog

Staff Spotlight: Jake Furby

This is a series of staff spotlights – showing the people behind the organisation! First up with have our Communications Manager: Jake Furby.

Blog

Reflective Blog: Mitie AGM and the Ethnicity Pay Gap

In this reflective blog, I would like to share my experiences and insights from the AGM, where I had the opportunity to stand up and advocate for voluntary ethnicity pay gap reporting.

Blog

Pride Month

LGBTQIA+ (Lesbian, Gay, Bi, Trans, Queer, Intersex, Asexual and +) Pride Month is a significant time to reflect, renew, and invigorate the movement for LGBTQIA+ equality.

Blog

Welcome to two new Trustees

We are thrilled to have you here, and we can’t wait to share exciting stories, insights, and updates from the foundation.

Blog

Introducing Charlie Crossley, our new Investment Engagement Manager

Charlie is based in London. In this interview Charlie shares his work experience and motivations in joining the foundation, and talks about the foundation’s ‘4Ds strategy’.

Blog

Foundation Practice Rating Year Two Friends Provident Foundation Reflections

We recognise the need to improve in the three domains of diversity, accountability, and transparency, both individually and as a wider sector, with the aim of bring about change.

Resource

Report and Financial Statements 2021-2022

Resource

Climate emergency declaration

Friends Provident Foundation recognises that business as usual risks climate breakdown with profound consequences for people and planet.

Resource

Financial Inclusion: Annual Monitoring Report 2022

Poorest citizens ‘worn down’ as financial inclusion remains distant dream for the UK. The UK has made little progress in the last decade towards creating a truly financially inclusive society, a new study reveals.

Blog

Conference 2022 – Reflection

This year we were delighted to hold our conference at Toynbee Hall, in London.

Events

Annual Conference 2022

We shall be hosting our Annual Conference on Wednesday 23rd November at Toynbee Hall, London.

Blog

Reflections on Utilising Whole Endowments for Mission event

At Friends Provident Foundation, we believe that an organisation’s mission must be aligned to all activities undertaken by the organisation.

Blog

Community wealth and asset approaches for London

People across the country are facing historic hikes in their living costs.

Events

Utilising whole endowments for mission – peer to peer learn and share

Friends Provident Foundation and EIRIS Foundation invite trustees and staff of mission-led asset owners to join us to explore why and how to utilise their endowments for mission and positive impact.

Blog

Friends Provident Foundation to triple capital allocation

Friends Provident Foundation has today announced it will more than double its investment in award winning impact fund Snowball with immediate effect and will invest a further £1m for every £10m Snowball raises.

Resource

Equity and Social Justice Strategy

This is our first update on our equity and social justice plan. You can access this report as a word file, a html website page and as a pdf document.

Resource

Diverse organisational models to address economic, environmental and social challenges

This report illustrates diverse ways of structuring business activity that differ from the widespread and established model of external equity ownership and governance.

Resource

Report & Financial Statements 2020-2021

Blog

Equity and Social Justice

At the Friends Provident Foundation, we are dedicated to addressing social injustices and inequity in the economic system.

Blog

All working towards reforming UK grant-making

Deep and meaningful reform to UK grant-making is within reach.

Blog

Foundation Practice Rating

Friends Provident Foundation, as an initiator of the Foundation Practice Rating (FPR), is proud of the impact it is having in our sector.

Blog

Asset manager net zero commitments to be tested at Standard Chartered AGM

Voting at this year’s Standard Chartered AGM is going to be revealing regarding the depth of asset manager commitments to net zero and ESG.

Blog

It’s time to diversify economics to help reclaim it

Why does it appear that the economy is failing to meet humanity’s and our planet’s needs?

Resource

Living well in retirement

An investment and delivery framework to enable low income older home-owners to repair, improve and adapt their homes.

Resource

COP26 declaration: asset owner climate expectations of asset management

We are pleased to join 24 other asset owners as a founding signatory to the ‘COP26 declaration: asset owner climate expectations of asset management’.

Blog

Leveraging all our capital for a Just Transition

We are delighted to be at COP26 today to speak at the London School of Economics Grantham Research Institute fringe event on ‘How we can deliver a Just Transition’.

Blog

OUTstanding LGBT+ Future Leaders

Our colleague Jake Furby, our Communications Manager since March was nominated to OUTstanding LGBT+ Future Leaders Role Model List 2021.

Blog

It is time to end greenwashing in asset management

We are pleased to join 24 other asset owners as a founding signatory to the ‘COP26 declaration: asset owner climate expectations of asset management’.

Events

Annual Conference 2021

Our annual conference has passed, however, below captures some main themes covered on the day.

Resource

Economist Education Video

When Friends Provident Foundation (FPF) began its programmeme to explore how the economy might serve society better, it was based on several views.

Blog

Programme Advisory Group – Reflections by Dan Jones

Dan Jones one of our PAG members has reflected on his experiences of being a PAG member.

Blog

Economist Education Poem

Do you care about life in the oceans, the quality of air about local communities and equal opportunities about our history, local and worldwide, the global south and western divide.

Blog

Decolonising Economics

Friends Provident Foundation is an independent charity that makes grants and uses its endowment towards a fair and sustainable economic system that serves society

Blog

LGBTQ+ Pride Month

This article explores Pride from a personal perspective and how as organisations we can be more LGBTQ+ friendly.

Resource

Report & Financial Statements 2019-2020

Blog

Anti-Racism Blog (A personal perspective)

As we come to the anniversary of George Floyd’s murder, Jake Furby our Communications Manager reflects on being a mixed-race person working in the charity sector.

Blog

Accountability, Transparency and Diversity Rating System

As friends, grant-holders and wider stakeholders know, Friends Provident Foundation is committed to principles.

Blog

Mental Health Awareness Week Blog

This article explores why Mental Health Awareness is important.

Resource

Charity Finance Article ESG olympics state of the sector report

This article explores our publication in Charity Finance magazine on our ESG olympics ‘state of the sector’ report and our recommended minimum standards.

Resource

Changing the balance: lessons learned from sharing power, ownership and control

On 15 December 2020 Friends Provident Foundation (FPF) hosted a virtual roundtable of recent and current grant recipients.

Blog

Equality, Diversity and Inclusion

Hi there, my name is Jake and I am the Communication Manager for Friends Provident Foundation.

Blog

When grantholders don’t laugh at your jokes

When grantholders don’t laugh at your jokes. This blog explores funder power/grant holder relationship.

Resource

ESG investing olympics -state of the sector report

Three charities – Friends Provident Foundation, Joffe Trust and Blagrave Trust – came together to launch the 2020 ‘ESG investing olympics’.

Blog

‘ESG investing olympics’ state of the sector report launched

This article explores an analysis of ESG proposals from 60 investment managers

Blog

Journeying to a new economy that respects people and nature

This article explores the impact globalisation has had on the people of Treherbert, Rhondda Valley in South Wales.

Blog

Where is the ‘S’ of ESG and what is needed?

This article discusses sustainability within ESG.

Events

Sharing power and getting things done

Towards the end of 2020, the Foundation hosted a virtual roundtable for some of our recent and current grant recipients.

Resource

The Behavioural Economy

This report sets out a 10-point plan to upgrade economic policy with a deep understanding of human behaviour at its core.

Blog

Putting humans at the heart of economic policy

This article explores the impact of the Coronavirus Pandemic

Blog

Applause for SSE’s sector first Just Transition strategy

This article comments on the Energy utility company SSE who has just published a sector first Just Transition strategy.

Blog

Uniting the circular economy and social justice

This article explores the tension between social justice and environmental sustainability.

Blog

Solar trains pioneer first UK business to make legal commitment to ‘just transition’

Solar trains company Riding Sunbeams has incorporated the principles of a just transition into its legal working agreement.

Blog

What is at stake in the upcoming reform on corporate sustainability reporting in the EU?

The Alliance for Corporate Transparency project, coordinated by Frank Bold, is at a turning point after providing the largest research to date on the state of corporate sustainability reporting in the EU.

Blog

Cazenove declared winner of the ‘ESG investing olympics’

This blog announces the winner of the ESG Olympics

Blog

Are future generations around your board table?

This blog explores Are future generations around your board table?

Blog

Developing financial resilience in individuals, communities and economies

This blog explores our programmeme which focuses on how the economy can serve society better.

Blog

Supporting communities to power a sustainable low-carbon future

This blog was written for Community Energy Fortnight 2020.

Blog

Unusual collaborations for unusual times

This blog explores the Centre for Cities’ webinar set out the latest statistics on unemployment across the country, as measured by Universal Credit and Job Seekers Allowance.

Blog

The Economics of Belonging

Published by the Foundation’s journalist fellow, Martin Sandbu, this fascinating new book explores a radical new approach to economic policy.

Blog

Short food supply chains needed in the face of climate change and pandemics

Shorter food supply chains can make the UK more resilient in the face of pandemics and climate change – but only with bold government intervention, according to a new Soil Association report.

Resource

Shortening Supply Chains: Roads to Regional Resilience

This report looks at innovative farmers, businesses and councils who are proving sustainable sourcing can be more resilient as well as being more environmentally friendly.

Blog

Open letter to asset managers ahead of climate vote at today’s Total AGM

An open letter to asset managers ahead of the climate vote at the Total AGM on Friday 29 May 2020.

Blog

Total’s climate ambition is poor, investors must support our shareholder resolution

In April, we were delighted to co-file Friends Provident Foundation’s first ever shareholder resolution.

Blog

Stewarding our land for current and future generations – inspiration from the Welsh Valleys

One positive outcome of our current situation, is probably a greater awareness of the importance of the places in which we live.

Resource

The Colour of Money: race and economic inequality

This report – by Dr Omar Khan of Runnymede – focuses on how economic and wider social inequalities affect Black and minority ethnic (BME) people in Britain.

Blog

The Colour of Money: race and economic inequality

Black and minority ethnic (BME) people in Britain face extensive and persistent economic inequality, finds Runnymede’s latest report The Colour of Money: How racial inequalities obstruct a fair and resilient economy.

Resource

Report & Financial Statements 2018-2019

Resource

Time for Action

This report focuses on the role of the financial system.

Blog

Time for Action

This new report by the Financial Inclusion Centre focuses on the role of the financial system.

Events

An invitation to the ESG ‘investing olympics’

Three charities have invited asset managers to make proposals for the investment of £33.5 million in an initiative called the ESG ‘investing olympics’.

Blog

Charities launch ESG ‘investing olympics’

Three charities have invited asset managers to make proposals for the investment of £33.5 million in an initiative called the ESG ‘investing olympics’.

Resource

Investment Mandate Request for Proposals

Friends Provident Foundation, the Joffe Trust and the Blagrave Trust are inviting asset managers to make proposals for the management of funds totalling £32m.

Blog

Funders come together on climate change

Some of the biggest names in charity funding have made a public commitment to play their part in tackling climate change.

Blog

Time for a Carer’s Passport

Carers in the workplace should be provided with a ‘carer’s passport’ which would qualify them for financial support.

Resource

Power to Participate: a specification for community energy to participate in a flexible energy system

This report looks at how our electricity system is changing.

Blog

Staying flexible: why aren’t communities providing more network flexibility services?

Regen’s senior project manager, Tim Crook, explains how community energy organisations could play a bigger role in providing network flexibility.

Blog

Friends Provident Foundation lends its support to global strike for climate

Friends Provident Foundation lends its support to global strike for climate.

Resource

Women at work: Designing a company fit for the future

This report by Friends Provident Foundation journalist fellow Deborah Hargreaves sets out to examine what would happen if women could re-imagine the way they work and how the business is run.

Blog

Women at work – designing a company fit for the future

If women could re-imagine the way they work and how the business is run, what would they do?

Blog

York Festival of Ideas: How does the economy work, who benefits and who loses?

York Festival of Ideas runs from 4 June to 16 June and will present over 200 mostly free events under the banner of A World of Wonder.

Blog

Women at work: designing a company fit for the future

The blog explores women at work: designing a company fit for the future.

Resource

Report & Financial Statements 2017-2018

Blog

Rating Private Sector Political Transparency

Transparency International is the world’s leading non-governmental anti-corruption organisation.

Blog

Check out The Money Question

This article explores Positive Money who have launched the Money Question.

Blog

If community energy is treated fairly, it will play a role in the just transition

The energy market is being disrupted like never before with economics, technology, and business model innovation driving a transition towards decarbonised, decentralised and more democratised energy.

Blog

Reshaping the economy to work for all: New Commission on a Gender – Equal Economy

At the Women’s Budget Group (WBG), we are best known for our analysis of UK government policy for its impact on women.

Resource

A review of current thinking about the nature of work and economic resilience

Projects funded by the Friends Provident Foundation contribute variously to proposing new solutions.

Blog

Brexit in Saxony

We’ve become familiar with a certain sinking feeling the morning after a big political event.

Resource

Economic inequality and racial inequalities in the UK

Inequality has risen up the public and policy agenda.

Blog

Purpose. Is it enough?

Earlier this year, Danielle Walker Palmour was privileged to accept an invitation from Philanthropy Australia to give the closing keynote speech.

Blog

Women in the workplace

There are many inspirational women who are trying to do things differently in order to make work suitable for them – often challenging entrenched views on their roles and functions.

Resource

Evaluating the Building Resilient Economies Programme

In 2013 Friends Provident Foundation launched the Building Resilient Economies programmeme, motivated by the failures of the economic system to meet the needs of society and the environment.

Blog

Journalist fellowship line-up announced

This blog is about our fellowship award

Events

Friends Provident Foundation Conference 2018

Friends Provident Foundation Conference 2018 brought together our grantholders, partners and investees to meet, share skills and ideas on the economy and to explore how we can maximise our impact.

Blog

Evaluating the Building Resilient Economies Programme

This blog is about Building Resilient Economies.

Blog

Making good decisions for the future

Shea Buckland-Jones from the Institute of Welsh Affairs shares his personal experience of the Well-being of Future Generations Act 2015

Blog

Why pensions are both dangerous …. and exciting!

Pensions can seem like a dauntingly complex and – let’s be blunt – boring subject.

Blog

The energy system is in flux, let’s ready ourselves for a community takeover

Good news! The transition to a decarbonised, decentralised and democratised energy system is underway, says Colin Baines, Investment Engagement Manager at Friends Provident Foundation.

Blog

Building energy resilience in low income communities

What happens to low income households whose energy bills suddenly increase?

Resource

Creating a Social Care Trust Fund

This Select Committee Report outlines that a citizens’ wealth fund could provide long-term sustainable funding for adult social care, ensuring that everyone is treated fairly and equally whatever their health needs.

Blog

Fair pay for fair work: a look at executive compensation

Last year we supported the introduction of mandatory executive pay ratio reporting, which is expected to become law soon.

Resource

Fair Pay for Fair Work: A Look at Executive Compensation

This report by St Paul’s Institute makes recommendations to build on the recently improved disclosures on pay ratios.

Resource

Remodelling Capitalism: how social wealth funds could transform Britain

A pioneering new citizens’ wealth fund in the UK could provide a universal annual cash dividend and eventually a weekly basic income.

Events

Remodelling Capitalism: how social wealth funds could transform Britain

The launch of a new report on how social wealth funds – collectively owned investment vehicles with social aims – could transform Britain, took place in London on 10 May 2018.

Blog

Creating Britain’s first citizens’ wealth fund

A pioneering new citizens’ wealth fund in the UK could provide a universal annual cash dividend and eventually a weekly basic income, says a new report, Remodelling Capitalism – How Social Wealth Funds could transform Britain.

Resource

Building Community Resilience

This report explores how community benefit societies can support the shift towards a more resilient, sustainable and fairer economic system.

Blog

Tackling the drivers of wealth inequality

We need a Citizens’ Wealth Fund so everyone shares in economic growth, says Carys Roberts from IPPR

Resource

Report & Financial Statements 2016-2017

Blog

A food and farming system that’s ‘best in show’

What does a future-proof farming and food economy look like?

Blog

Journalist Fellowship 2018

The Friends Provident Foundation Journalist Fellowship 2018 reflects the Foundation’s ongoing commitment to support new ideas about how we can build a fair and more resilient economy to drive a better world.

Blog

A new partnership begins

Friends Provident Foundation and New Philanthropy Capital are now working in partnership to evaluate the foundation’s Building Resilient Economies programmeme and its wider impact.

Blog

Switching millennials on to saving

A newly published report by ShareAction, Switching millennials on to saving, draws together arguments about the need to tackle low levels of saving.

Blog

A revelatory and entertaining book

A revelatory and entertaining book about the pitfalls of how we measure our economy and how to correct them, has been published.

Events

Grantholder Conference 2017

The Friends Provident Foundation Grantholder Conference 2017 proved to be a popular event and was full to capacity with representatives from almost all of our grantholder organisations attending.

Blog

A first for the UK

Mean Moor Community Wind Farm in Cumbria is thought to be the first wind farm in the country to be transferred to community ownership from a commercial developer.

Blog

Setting the bar higher

Danielle Walker Palmour explains how a determination to use all of Friends Provident Foundation’s resources in pursuit of its mission.

Blog

Making the case for building local economies

Centre for Local Economic Strategies

Blog

Moving Beyond Neoliberalism

As part of the recent Festival of New Economic Thinking, we supported the launch of Michael Jacobs and Laurie Laybourn-Langton’s thought provoking report Moving Beyond Neoliberalism.

Resource

Gridlock in UK Power Markets: How Big Six capture of the regulatory process poses investor risk

This report examines energy utilities and risks arising from the market transition to decarbonisation, decentralisation and democratisation (3Ds).

Resource

Financial Inclusion Annual Monitoring Report 2017

This report is the last in a series of five annual monitoring reports commissioned to monitor progress towards or away from financial inclusion in Britain.

Resource

Wise Minds: The energy transition and large utilities

The UK energy system is in flux. It is changing more quickly – and more fundamentally – than at any point since the Industrial Revolution.

Resource

Making the Most of Brexit

The UK’s decision to leave the EU creates both opportunities and risks in both the process of negotiation and the outcomes for the UK.

Resource

Moving beyond neoliberalism

Neoliberalism – the set of socioeconomic ideas and policies which have dominated public life over the last 40 years – has failed.

Resource

Financial Innovation Today, Toward Economic Resilience

We are at the threshold of a cultural war over the meaning of money.

Resource

Community Energy at a Crossroads

Community energy is at a crossroads, following recent reductions in government support and subsidy.

Resource

Financial Inclusion Annual Monitoring Report 2016

This report is the fourth in a series of five annual monitoring reports commissioned to monitor progress towards or away from financial inclusion in Britain.

Resource

Creating Good City Economies in the UK

In 2015 the Friends Provident Foundation awarded funding to the Centre for Local Economic Strategies and the New Economics Foundation.

Resource

Report & Financial Statements 2015-2016

Blog

The UK’s burgeoning alternative finance industry

A new report into the UK’s burgeoning alternative finance industry is calling on the Government to underwrite consumers’ investments in the sector in a bid to encourage wider participation.

Blog

Global investors sign letter to the G20

Friends Provident Foundation has joined with a range of global investors in signing a letter to the G20 in support of the adoption of the Paris Agreement in December 2015.

Blog

Journalist Fellowship Announced

Friends Provident Foundation announces David Pilling, Africa Editor of the Financial Times, as the winner of the first 2016 Friends Provident Foundation Journalist Fellowship.

Resource

2015 Clore Social Fellows

2015 Clore Social Fellows

Resource

Financial Inclusion Annual Monitoring Report 2014

This report is the second in a series of five annual monitoring reports commissioned by the Friends Provident Foundation to measure changing levels of financial inclusion in Britain.

Resource

People Powered Prosperity: Ultra-local Approaches to Making Poorer Places Wealthier

Can we find economic techniques which cities can use effectively to tackle their own market failures – and release their own wasted economic potential – and if so, why hasn’t this happened already?

Resource

Developing resilient local economies: good practice among local enterprise partnerships

Our project builds upon emerging thinking about the kind of post-recession economy we are building in Britain, and the kind of economic growth that we are seeking to achieve.

Resource

Co-op Clusters

This report presents findings from research conducted into the problems restricting the growth of co-operative housing.

Resource

Community Chest

The UK’s economy is unbalanced in two ways.

Resource

Financial System Resilience Index

This report on resilience in financial systems, from the New Economics Foundation, richly repays reading.

Resource

Resilient economies video wall

The specific question we posed to them was: “What would you do if you had a million pounds to build a more resilient economy?” The video wall below showcases their responses …

Resource

Women’s financial assets and debts

Fawcett launched a new project in March 2006 to plug gaps in understanding of the differences between women’s and men’s financial assets and debt.

Resource

Living well in retirement

An investment and delivery framework to enable low income older home-owners to repair, improve and adapt their homes.

Resource

Mapping Economic Resilience

This report was compiled for Friends Provident Foundation by nef to assist its development of a new social change programmeme.

Resource

How financial inclusion and consumer issues might impact on the new Financial Conduct Authority

The paper reports on a seminar held in 2012 to discuss financial inclusion in the new regulatory environment.

Resource

The Store: evaluation

Funders and stakeholders wanted to assess the sustainability of the rent-to-own model developed by The Store social enterprise in Stanley, Co. Durham.

Resource

Emotional relationships with money and financial behaviour: Analysing the Big Money Test

In 2011 over 100,000 people took part in the BBC LabUK’s Big Money Test, a survey launched on the consumer affairs programmeme Watchdog.

Resource

How much does ‘free banking’ cost?

This assessment is important and topical due to rising international regulatory disapproval of the pricing methods.

Resource

Can payday loan alternatives be affordable and viable?

London Mutual Credit Union (LMCU) had become increasingly alarmed by the escalating and often detrimental use of costly payday loans by already overindebted households.

Resource

Sustainable Debt Advice Project Pilot: Final Evaluation

AdviceUK, in partnership with Payplan and ACM Solutions1, has conducted a pilot to test the viability of a sustainable debt advice model.

Resource

Financial inclusion in social housing: policy into practice

More than one in four households in Britain is excluded from mainstream financial services.

Resource

Right Use of Money

As the world continues to become ever more interconnected and complex, the decisions we take when spending and investing money not only affect ourselves.

Sign up to our newsletter

Get the latest updates from our grant holders, our partners and the Foundation straight to your inbox. Please note that by signing up to the newsletter you are agreeing to and ‘opting in’ to the terms of the Privacy Notice.