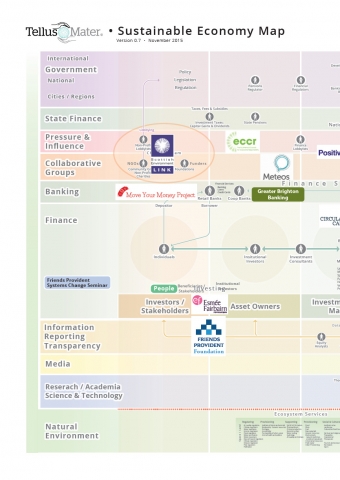

The UK is the home of Europe’s rapidly-growing “AltFin” movement – encompassing peer-to-peer lending, community share schemes and crowdfunding.

Fast becoming a major player in the financial sector, it was valued at £3.2 billion in 2015 – almost five times the 2013 figure.

In what is the first independent qualitative evaluation of the sector, academics from the University of Leeds interviewed companies at the vanguard of the movement to understand their motivations.

Their report, Financial Innovation Today: Towards Economic Resilience, launched today, and funded by the Friends Provident Foundation, examines the sector’s role in democratising finance and building economic resilience.

They found a dynamic social movement encompassing multiple innovative finance models, trade bodies and regulators. But they make recommendations aimed at boosting confidence among consumers to encourage wider participation and improve public understanding of finance.

Lead author Dr Mark Davis, an Associate Professor in Sociology, argues that to deliver progressive social change, people need to do different things with their money and break the habit of using high street banks.